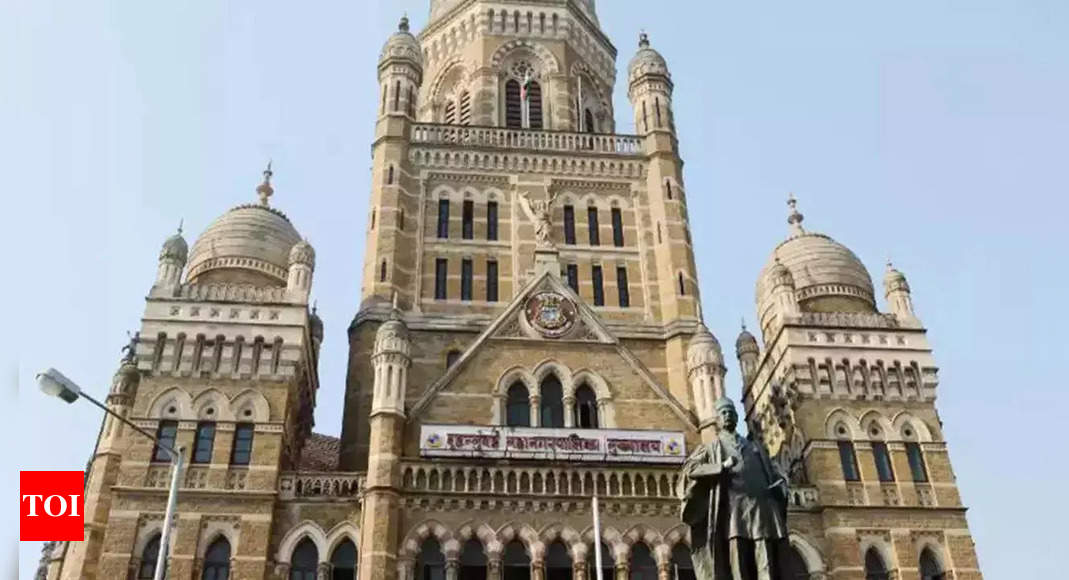

Mumbai’s richest civic body, the BMC, is facing a significant financial burden with liabilities soaring to an all-time high of Rs 1.9 lakh crore. These liabilities include what the BMC owes to contractors and creditors and have surged due to mega infrastructure projects like the coastal road that began in the last five years. According to the BMC’s 2023-24 budget document, the liabilities had already reached Rs 1.4 lakh crore by March 2023 and have since risen to nearly Rs 2 lakh crore with the sanctioning of more projects.

Critics are concerned that such massive spending could hamper the BMC’s ability to initiate new projects in the coming decade and may overlook the needs of future generations. However, BMC administrator I S Chahal has defended the high spending, stating that the long-gestation projects will create durable assets in a financially viable manner.

The BMC’s budget for the fiscal year 2023-24 was initially set at Rs 19,760 crore but has ended up exceeding the projected expenditure by more than double. Major projects contributing to this escalation include the proposed Dahisar-Bhayander Link Road, the Mumbai Coastal Road extension from Versova to Dahisar, and the Goregaon Mulund Link Road tunnel. Critics argue that these projects may not be aligned with the actual needs of citizens. Some experts are skeptical about the BMC’s strategy, questioning whether the projects are well thought out and cater to the larger traffic issue as opposed to serving a small section of the population.

Among those raising concerns is Milind Mhaske, CEO of NGO Praja, who pointed out that the BMC is investing in car-centric projects despite them being utilized by a small percentage of the city. A former BMC commissioner stated that the massive liabilities incurred could impact the needs of future generations, emphasizing the importance of well-thought-out projects that serve the broader population.

Additionally, the opposition has raised questions about the initiation of these projects after the term of the corporators ended in March 2022, potentially limiting adequate scrutiny. This has led to concerns about the actual utilization of the BMC’s large fixed deposits, which should also be allocated toward other financial obligations.

In the face of these concerns, BMC Commissioner I S Chahal has emphasized the city’s need for world-class infrastructure and assured that the completion periods for these projects span 5 to 7 years. He also highlighted the BMC’s sources of income, including revenue from development charges, property tax, and compensation received in lieu of octroi payments.

With the BMC’s liabilities reaching a record high, the trajectory of its future projects and investments remains a topic of scrutiny and debate. Historically, the BMC has faced numerous financial challenges as it strives to balance its infrastructure development and meet the needs of Mumbai’s growing population.

Overall, while the BMC’s significant infrastructure projects have the potential to improve the city’s overall development, concerns persist regarding the financial implications and long-term impact on future generations. The need for thorough scrutiny and considerations of a broader stakeholder’s perspective remains essential to ensure the city’s sustainable growth and development.

Leave a Reply